MSTR's Wild Ride: Why MicroStrategy's Dip is a Blip, Not a Bust

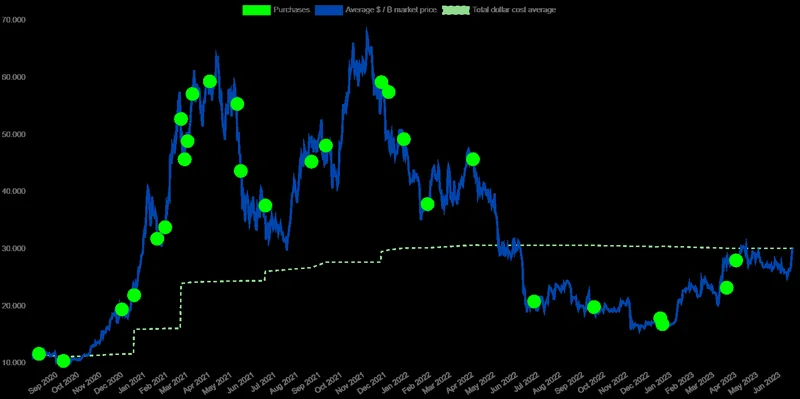

Folks, let's talk about MicroStrategy (MSTR). It’s been a rollercoaster, hasn't it? We’ve seen the stock take a nosedive, dropping 40% in the last six months. Headlines are screaming about investor caution and a "negative premium" – the unthinkable happening where MSTR's market cap actually dipped below the value of its Bitcoin holdings. The sky is falling, right?

Wrong. Absolutely, positively wrong.

This isn't a sign of impending doom; it's a pressure release valve. It's the market briefly forgetting the vision behind the numbers, the sheer audacity of Michael Saylor's bet on Bitcoin. Think about it: a software company transforming itself into a Bitcoin whale. It’s like watching a caterpillar decide it wants to be a rocket ship. A company shifting its entire business model to embrace a decentralized future!

There's been some turbulence, sure. Concerns about shareholder dilution, worries about debt – all valid points. The company raised the dividend on its preferred shares to 10.5% to revive demand, and there are plans to launch a euro-denominated preferred share, expecting $715 million in proceeds. Some analysts are even whispering about a "strong sell." But let’s not get lost in the weeds.

The Bitcoin Pendulum: A New Era

Here's the big idea, the one everyone seems to be missing: MicroStrategy isn't just holding Bitcoin; it's building a bridge. A bridge between the old world of traditional finance and the new world of decentralized, digital assets. And bridges, my friends, sometimes sway in the wind, it is important to remember that.

Remember the early days of the internet? Experts scoffed, established companies dismissed it as a fad, and fortunes were lost betting against the tide. But the internet, that decentralized network, changed everything. It democratized information, connected billions, and created entirely new industries. Bitcoin, and the blockchain technology that underpins it, has the potential to do the same for finance.

Strategy's stock is down, yes, and that’s a worry, but the analysts still believe in it. The average MSTR stock price target is about $523, indicating an upside potential of over 120% from current levels. Bitcoin prices rose more than 7x between January 2023 and October 2025, MSTR stock increased by 30 times. That’s an incredible return!

And that "negative premium" everyone's freaking out about? It's a temporary blip. It’s the market briefly losing sight of the forest for the trees. It's forgetting that MSTR offers something unique: a publicly traded company with a massive Bitcoin treasury, a way for institutional investors to gain exposure to crypto without directly holding the asset. MicroStrategy Briefly Worth Less Than Its Bitcoin as Market Flags Corporate Risk

What does it mean for us? It means the opportunity to be part of something transformative. To invest in a company that's not just chasing profits, but actively shaping the future of finance.

Of course, with great power comes great responsibility. We need to be mindful of the risks involved, the potential for volatility, and the ethical considerations of a decentralized financial system. It’s a brave new world, and we need to navigate it with wisdom and foresight.

The Future is Being Written Now

MicroStrategy's dip isn't a disaster, it's a discount. It's a chance to get in on the ground floor of a financial revolution. A revolution that's not just about making money, but about building a more open, accessible, and equitable financial system for everyone. And honestly, that's the kind of future I want to be a part of.